This VC firm can see the future.

They invested in Apple, Google, YouTube, WhatsApp, and Airbnb when they were NOTHING.

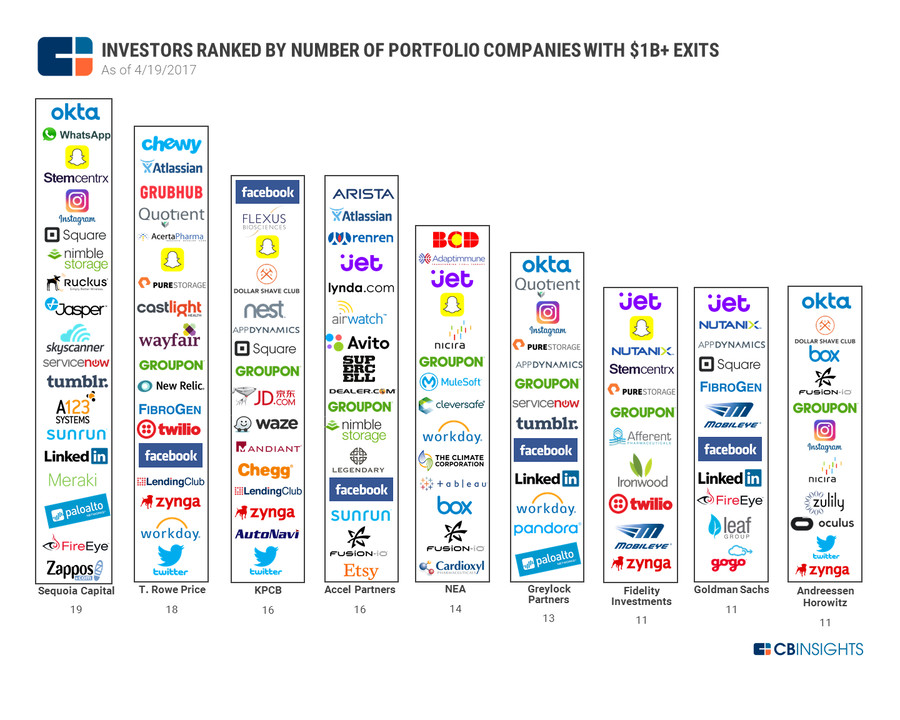

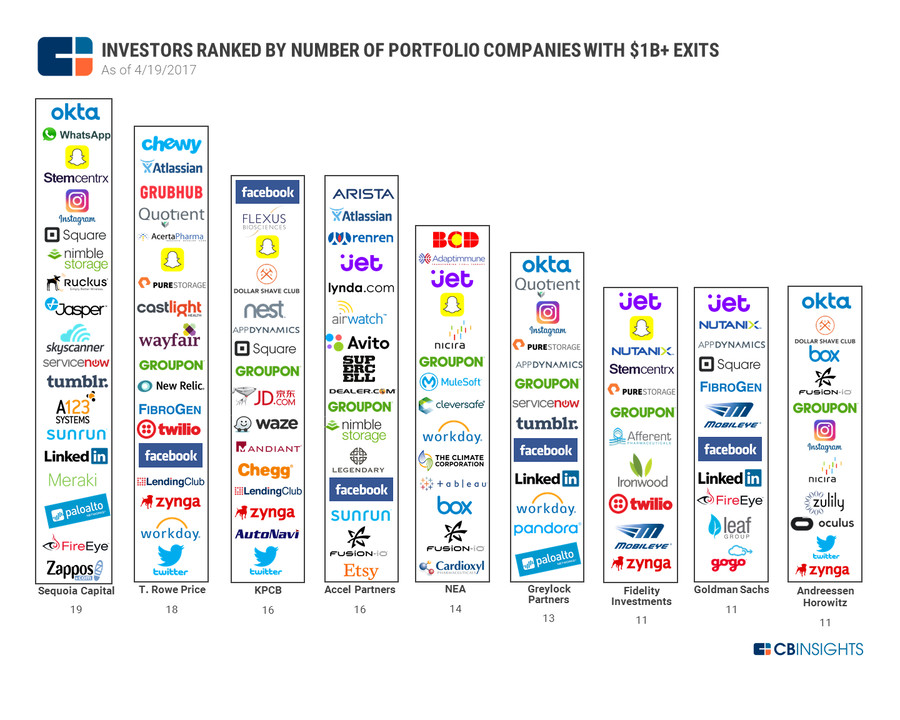

Their portfolio is now worth $3.3 TRILLION—20% of the entire NASDAQ.

Here's how Sequoia Capital spot the next billion-dollar companies:🧵

The secret isn't luck or genius...

Sequoia doesn't just throw money at startups.

They have a PLAYBOOK refined over 49 years that lets them see unicorns that will change the world.

Let me break it down for you:

1st Principle. The Prepared Mind.

"Chance favors the prepared mind," Sequoia partner Alfred Lin says.

They study market landscapes obsessively, mapping out every player and identifying white spaces BEFORE meeting founders.

They're ready when opportunity knocks.

When Sequoia first met Airbnb, they weren't starting from zero.

They'd been studying timeshares and vacation rentals for years, noticing that while hotels were being aggregated onto platforms, vacation rentals weren't.

They saw it right before Brian Chesky walked in.

Airbnb leveraged fintech to transform an entire asset class.

Incredible wealth comes from spotting transformations BEFORE VCs.

Think 'transformational' technologies creating or revolutionizing asset classes.

That's where generational wealth is built.

2. They ask two critical questions that matter more than anything else.

1. "Why now?"

2. "Who cares?"

These simple questions have led them to invest in companies that became worth billions.

"Why now?"

identifies what's changed that made this idea possible TODAY when it wasn't possible before.

Like DoorDash's "why now" was mobile phones creating access to a whole new class of on-demand labor.

"Who cares?"

forces founders to think about the future market, not today's.

1. If this solution were widely available, how many customers would want it?

2. How much would it improve their lives?

This helps Sequoia see massive markets BEFORE they exist.

3. They focus on market transformation, not credentials.

Don Valentine (Sequoia's founder) wasn't impressed by what school you went to or your past success.

He wanted to know:

• Is this market about to undergo massive change?

• Are today's solutions wrong for tomorrow?

4. Sequoia looks for founders with "founder-market fit."

When they met Tony Xu (DoorDash), they saw he had both strategy (focus on suburbs and merchants) AND operational excellence.

A perfect fit for the food delivery market, which requires both.

They invested in every round.

5. They understand compounding returns.

Sequoia holds investments for decades, not years. They know the real gains come from years 10-20, not 1-5.

Amazon made more money in year 21 than in the previous 20 years COMBINED.

That's why they stay in the game.

Unlike most VCs who rush to distribute shares, Sequoia HOLDS companies for 10+ years.

Their question:

"Does this company have BRIGHTER prospects in the future than today?"

If yes, they hold. That's how they turn millions into billions.

6. Sequoia thinks systematically about "what's next."

After investing in Apple, they realized computers would need better memory—so they funded disk drive companies.

They saw mice would be needed—so they invested in Xerox.

They connect dots others don't see.

Here's what I've learned studying them:

Great VCs don't pick companies that sound good today.

They pick companies that will be ESSENTIAL tomorrow.

Right now, there's one sector that's showing all the signs Sequoia looks for:

Water.

It's experiencing every indicator Sequoia values:

• Perfect timing ("why now?")

• Huge demand ("who cares?")

• Market undergoing massive change

• Current solutions wrong for tomorrow

• Potential for 10X compounding returnsAirbnb used tech to open an old asset class to new investors, creating massive wealth.

What if we applied those same principles to water?

We could transform another ancient asset class, create access for everyday investors, and build entirely new markets in the process.

Hi, I'm Ken Berenger.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is simple:

Share the formula for asymmetric wealth that cost me years, so you don't need to make the same mistakes.

This account exists because you don't have 100 years to figure it out, and you shouldn't have to wait for luck.

My current project is where water meets fintech—the heart of America's next industrial revolution.

Join me:

If Sequoia's playbook teaches you anything, it's that generational wealth isn't about luck—it's about recognizing patterns early and taking your chances.

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below if you found this valuable: