This man understands the markets.

He predicted:

1. Japan’s crash

2. The 2008 recession

3. The U.S.–China power shift

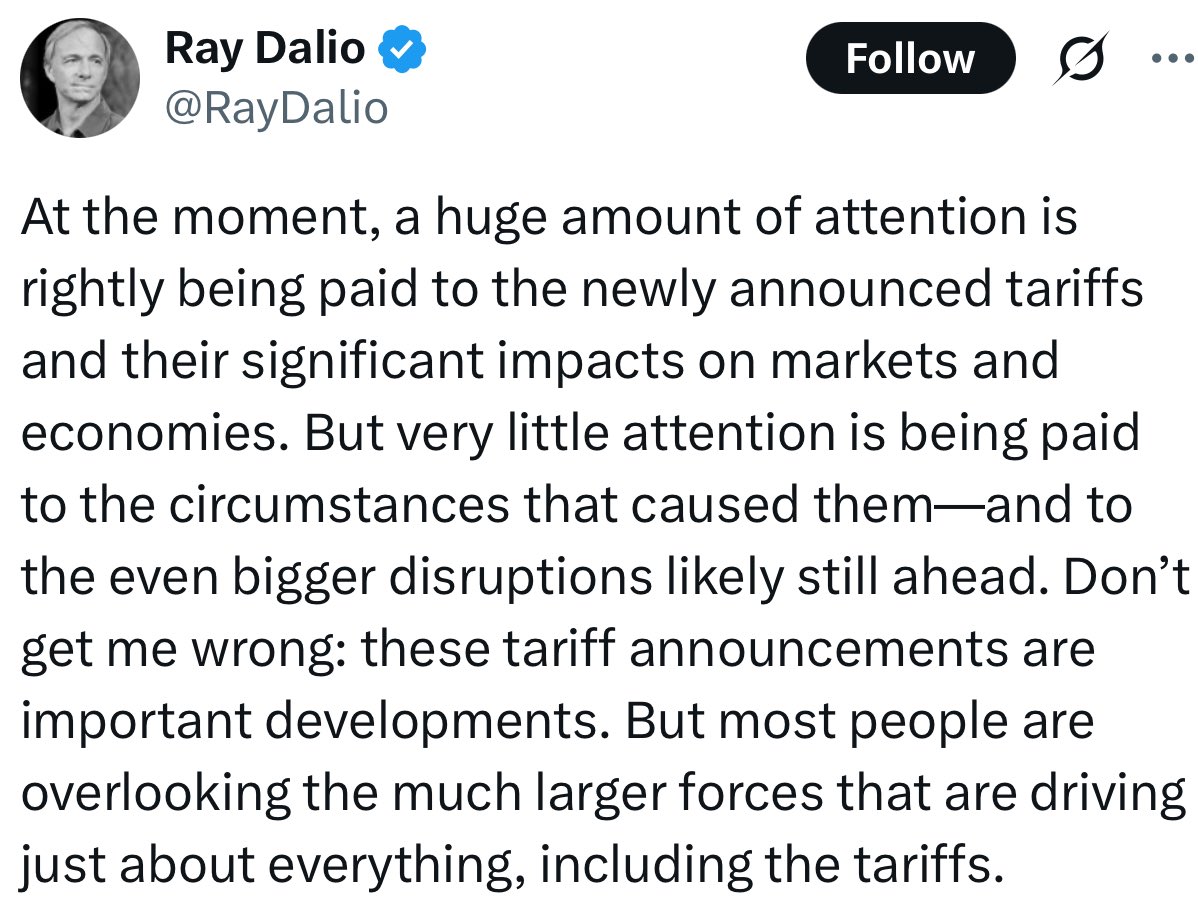

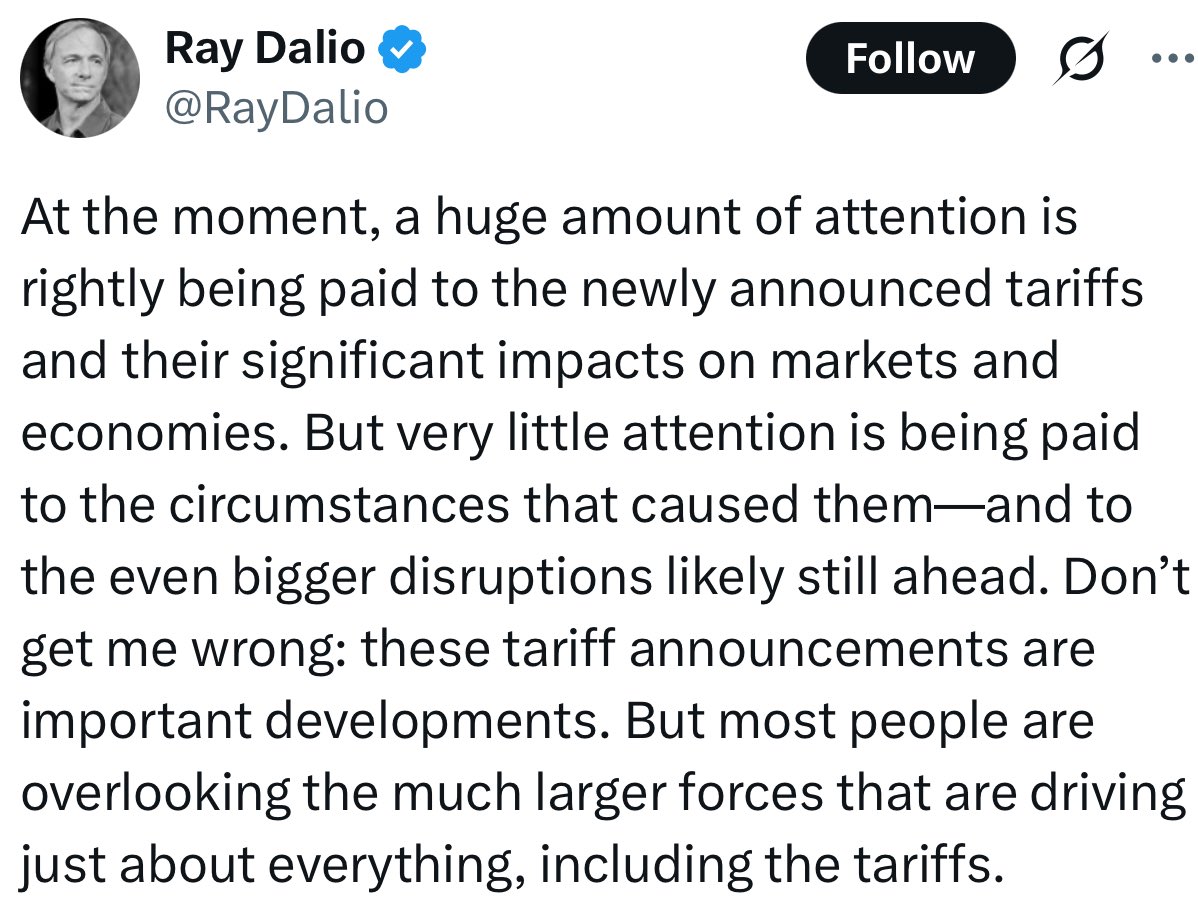

Ray Dalio just issued a new warning.

Here’s what he sees coming: 🧵

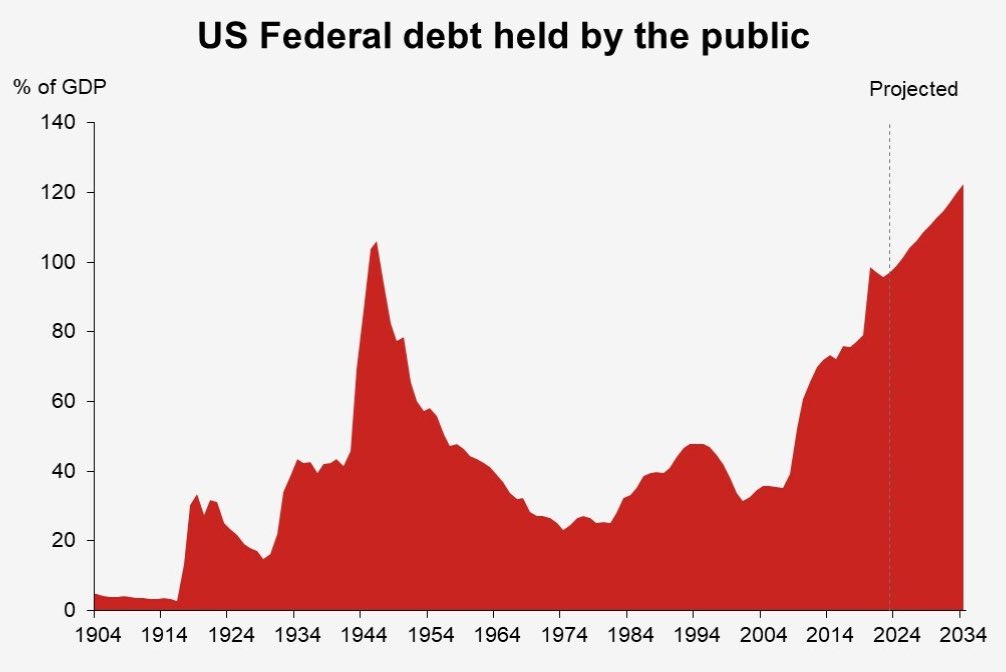

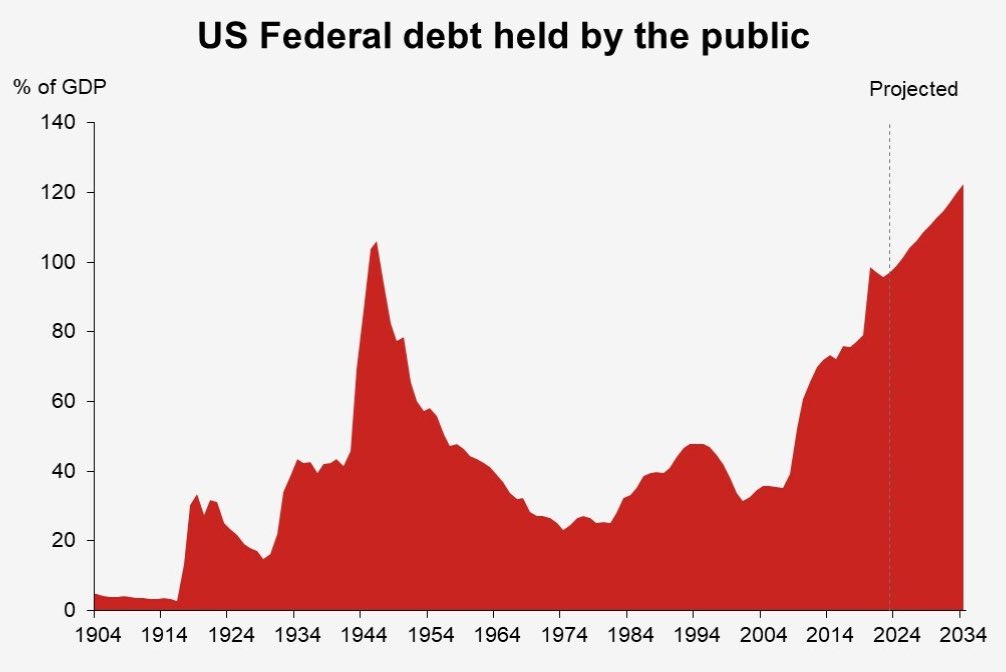

1. “We are at the end of a long-term debt cycle.”

He says the U.S. is entering a danger zone.

Debt-to-GDP is at 122%.

Government interest payments are hitting record highs.

This isn’t sustainable.

2. The 3 Big Forces Are Colliding:

Dalio says every major market shift is driven by 3 things:

• Debt + monetary policy

• Internal conflict

• External conflict

In 2025, all 3 are peaking at once.

That hasn’t happened since the 1930s.

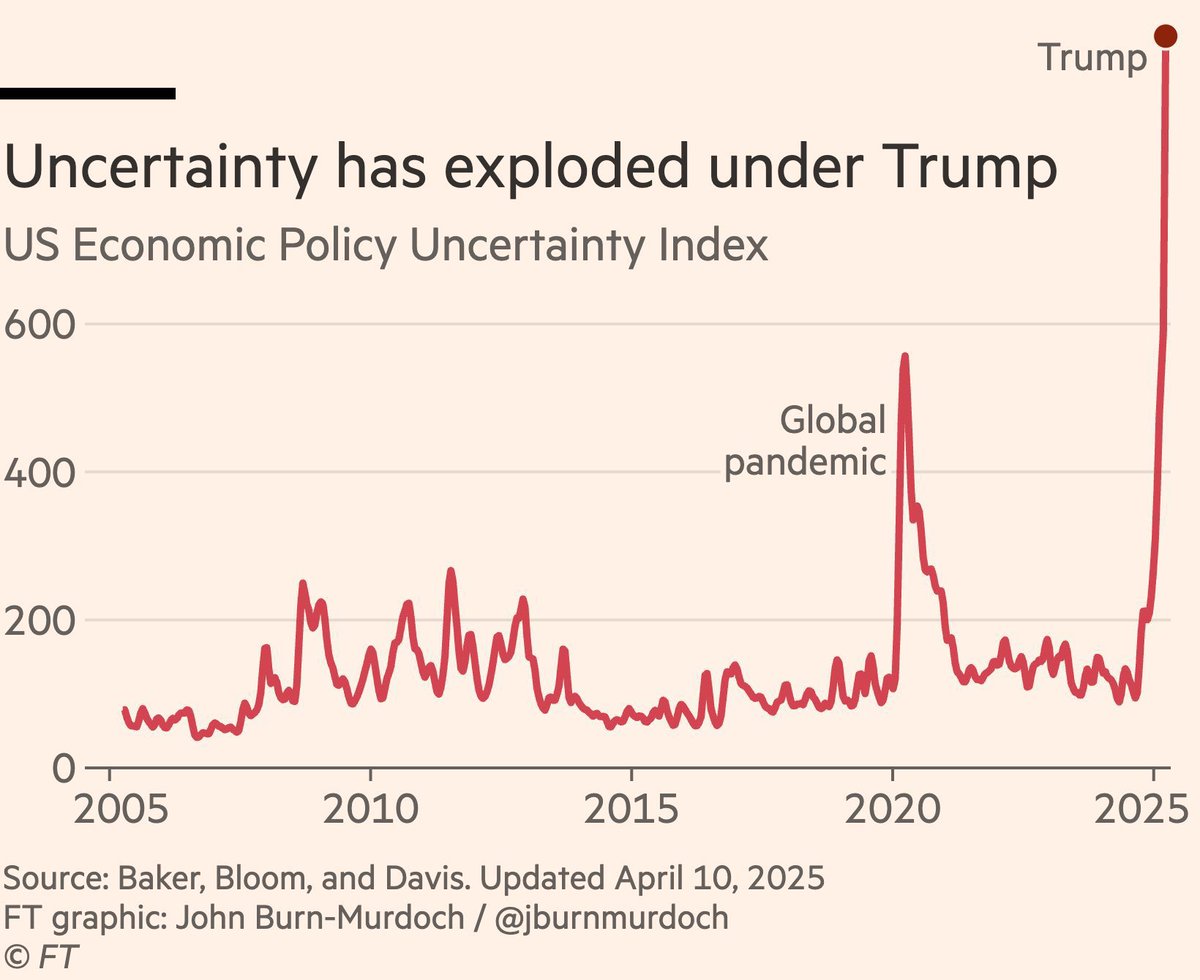

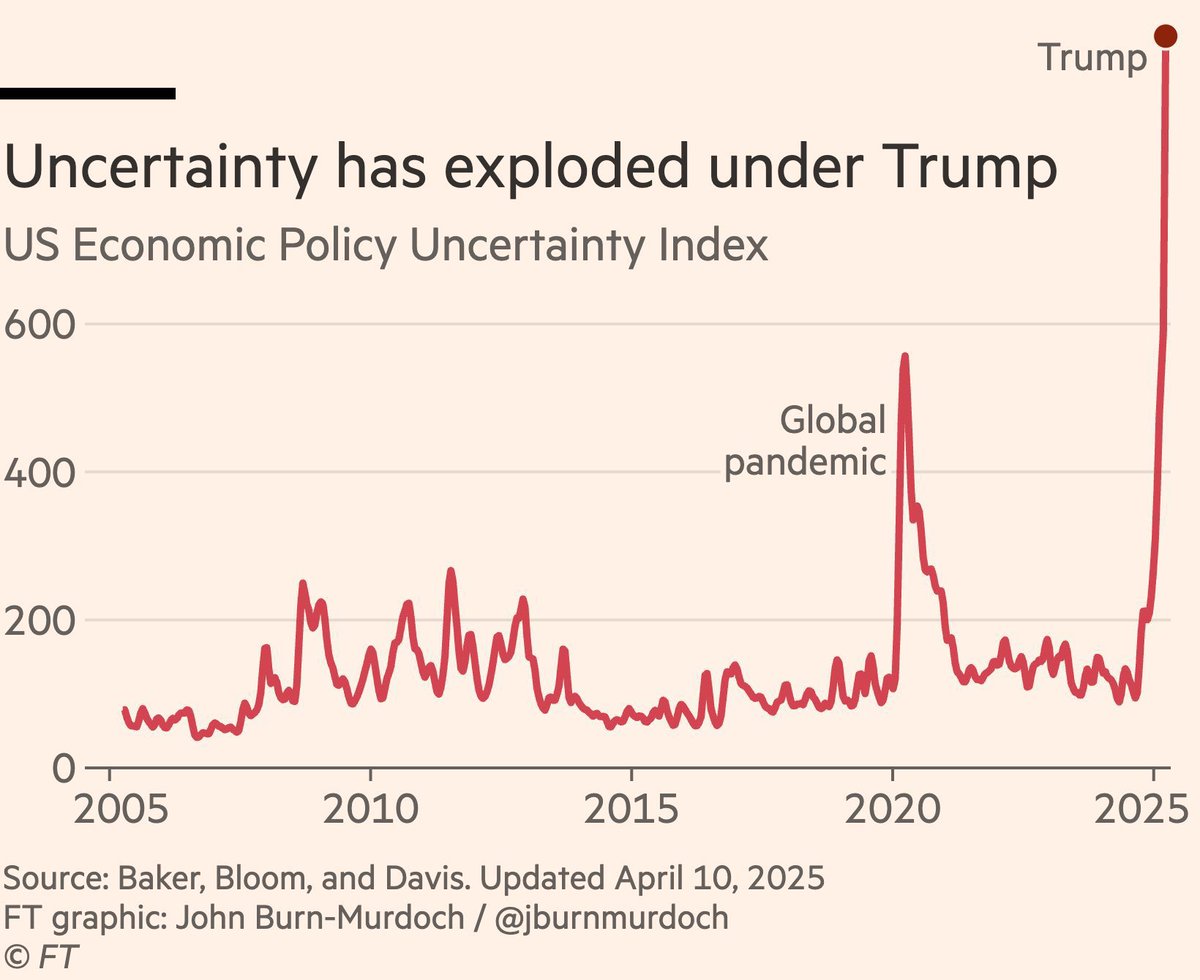

3. He’s most worried about political instability:

“We are in a type of civil war,” Dalio said.

The data supports it:

• Trust in government near record lows

• 2024 election lawsuits in 30+ states

• Rising violence tied to political identity

Markets don’t like chaos.

4. China vs. the U.S. is heating up:

Dalio says geopolitical tensions are now a market force—not just background noise.

60% of global trade touches the South China Sea.

Taiwan is the next flashpoint.

Trade, semis, even AI dominance are now in play.

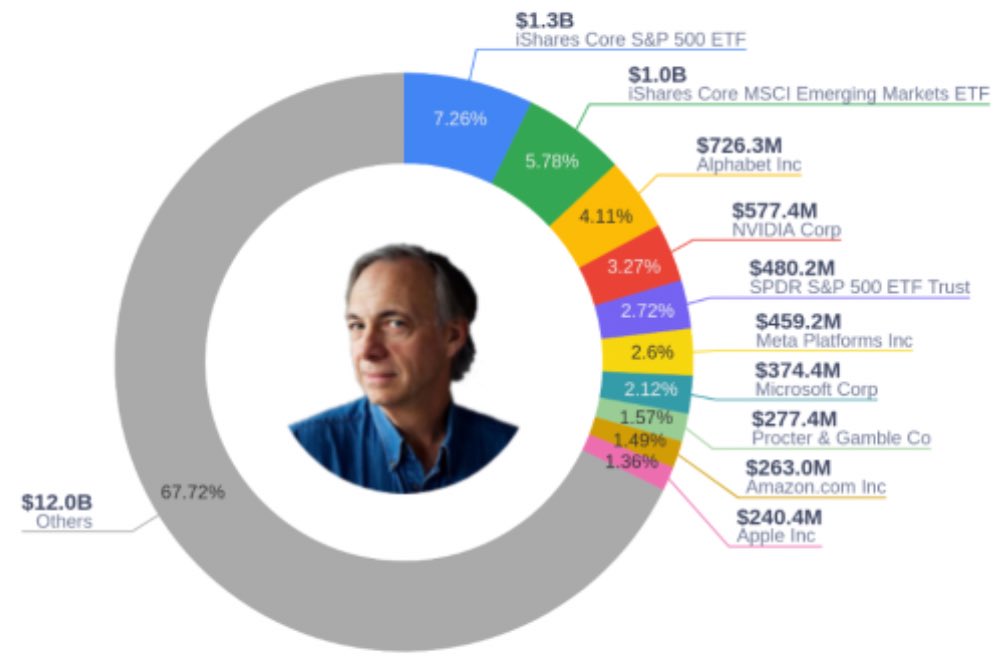

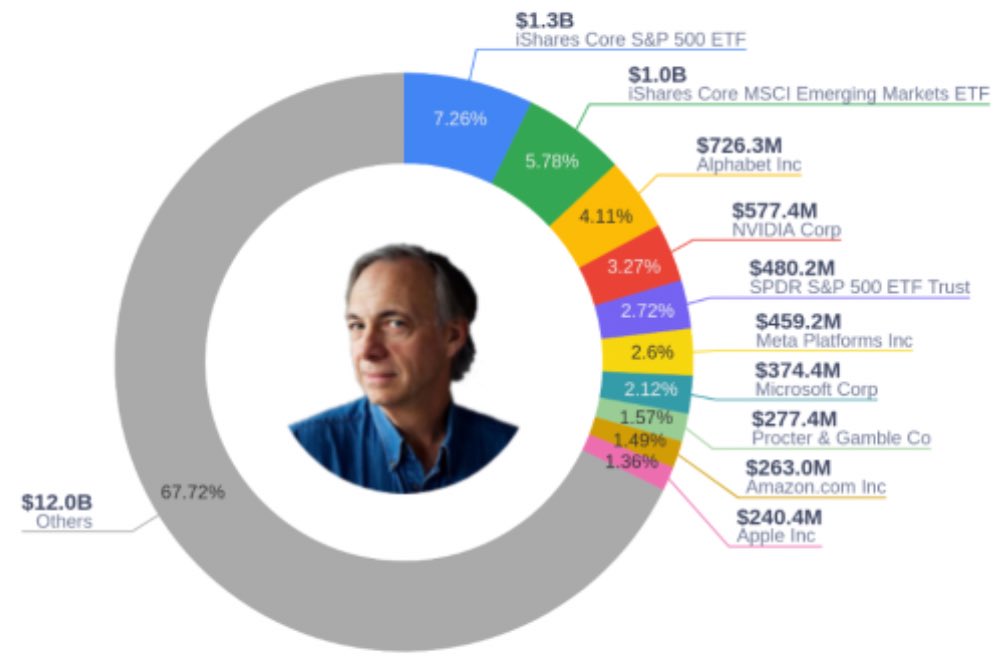

5. His portfolio? Radically different than 10 years ago.

Ray Dalio is focused on:

• Geographic diversification

• Hard assets like gold

• Neutrality in rising power conflicts

Translation: Don’t bet everything on the U.S.

6. Dalio’s bottom line:

The U.S. is “at risk of decline.”

Markets are entering a new paradigm.

Old models? Broken.

Passive investing? Riskier than it looks.

7. What to do about it?

• Get global exposure

• Own inflation-resistant assets

• Don’t ignore political/geopolitical risks

• Stay liquid. Stay nimble.

Dalio says:

“The greatest mistake investors make is thinking the past is a guide to the future.”

8. If Dalio is right, this decade won’t look like the last.

Stocks may still rise—but with more volatility, more surprises, and more risk.

This isn’t fear-mongering.

It’s preparation.

We do the research. You get the best undervalued stocks💡📊

Join 10,000+ investors getting exclusive picks weekly: