In 1965, Singapore was struggling with no resources. Today, the global financial powerhouse manages over $1 trillion in assets. How did this tiny nation become an investment behemoth? Here’s the story:

Singapore gained independence in 1965, a time when it had no natural resources. It had a small population of just 1.9M people, and unemployment was high. Its future was uncertain yet, in decades, it became an economic juggernaut.

Content Warning: Adult Content

Click to Show

The turning point? Lee Kuan Yew’s vision. Singapore’s first Prime Minister knew the country had one valuable asset: its location. He turned Singapore into a global trade and investment hub with 6 bold moves.

Content Warning: Adult Content

Click to Show

Number 1: Attract Foreign Capital • Singapore offered tax breaks & investor-friendly policies. • Global banks rushed in. • By 1970, it was already a financial center in Asia.

Number 2: Build World-Class Infrastructure • Singapore’s port became one of the busiest in the world. • Changi Airport became a key international hub. • Digital infrastructure made it an Asian tech capital.

Content Warning: Adult Content

Click to Show

Number 3: Create a Massive Investment Fund • In 1981, Singapore launched Temasek Holdings and then the Government of Singapore Investment Corporation (GIC). • These funds managed billions in sovereign wealth and investments.

Content Warning: Adult Content

Click to Show

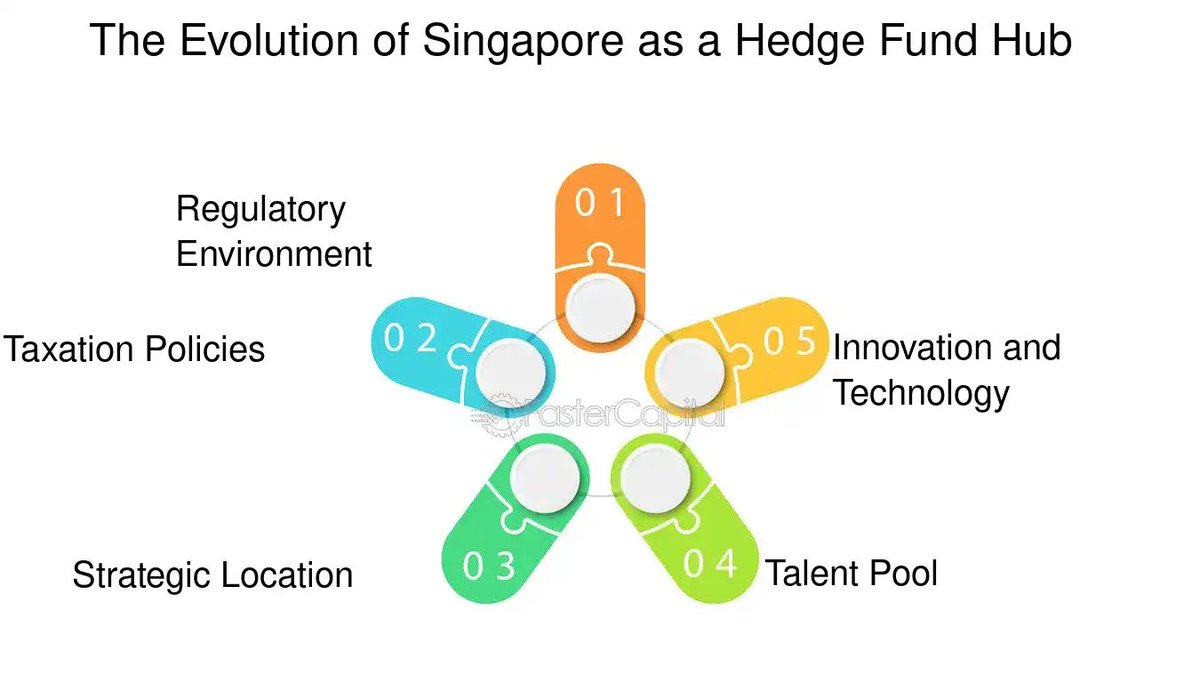

Number 4: Position as a Financial Hub Singapore became Asia’s banking & wealth management center Attracted foreign exchange markets & hedge funds Today, $4T+ flows through Singapore’s financial markets annually.

Number 5: Prioritize Education & Talent • Built world-class universities to train elite professionals. • Developed STEM-focused policies to attract tech talent. • Now ranks #1 in education globally.

Number 6: Smart Tax & Business Policies • Singapore's corporate tax is ~17% (vs. 21% in the US) • No capital gains tax (big for investors) • Clear, stable regulations encouraged startups & billionaires to move in.

Number 7: Initiate Free Trade Zone • Minimal tariffs and trade barriers • Signed over 25 Free Trade Agreements (FTAs) • Attracted global businesses to use Singapore as a gateway to Asia

Content Warning: Adult Content

Click to Show

Number 8: Boost Private Banking & Wealth • Ultra-low taxes (0% capital gains tax) • Strong banking secrecy & financial stability • Became home to thousands of family offices & hedge funds

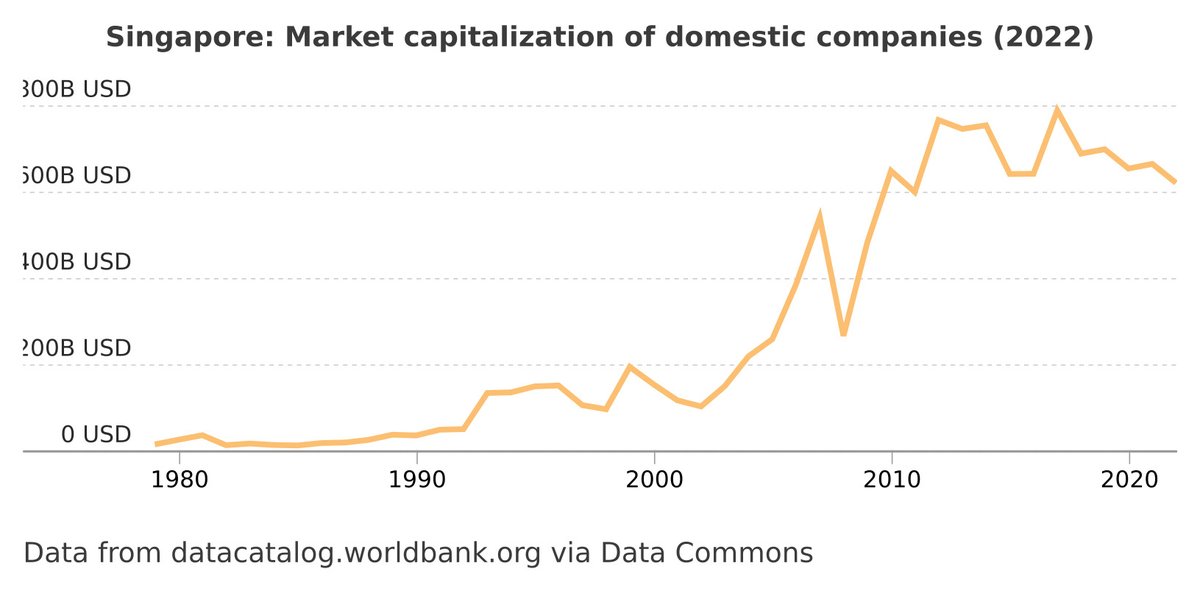

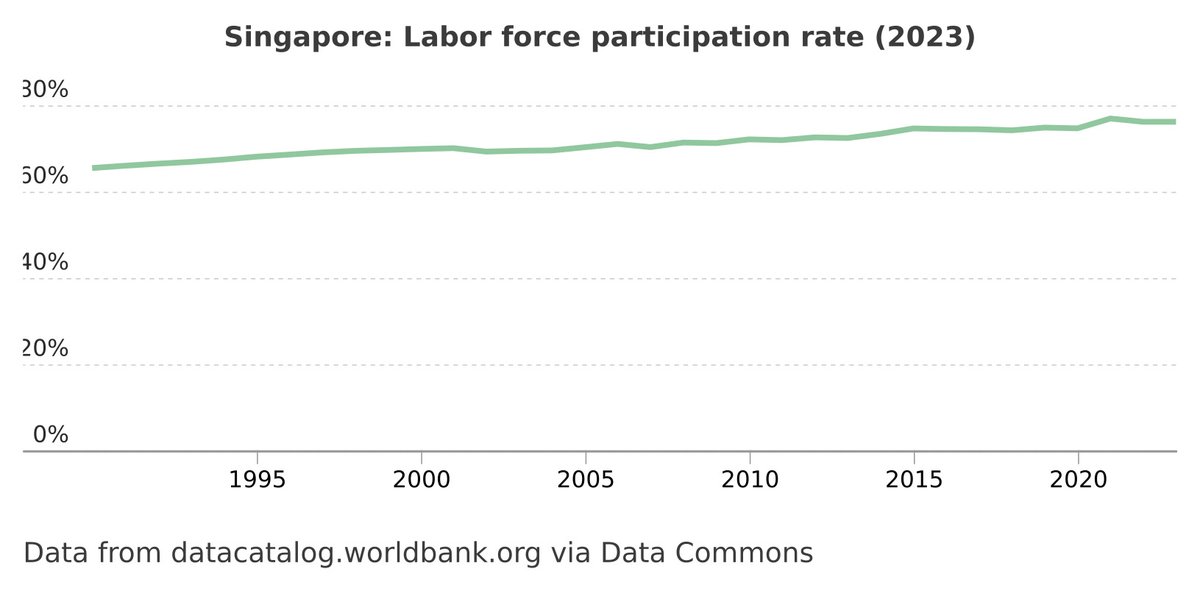

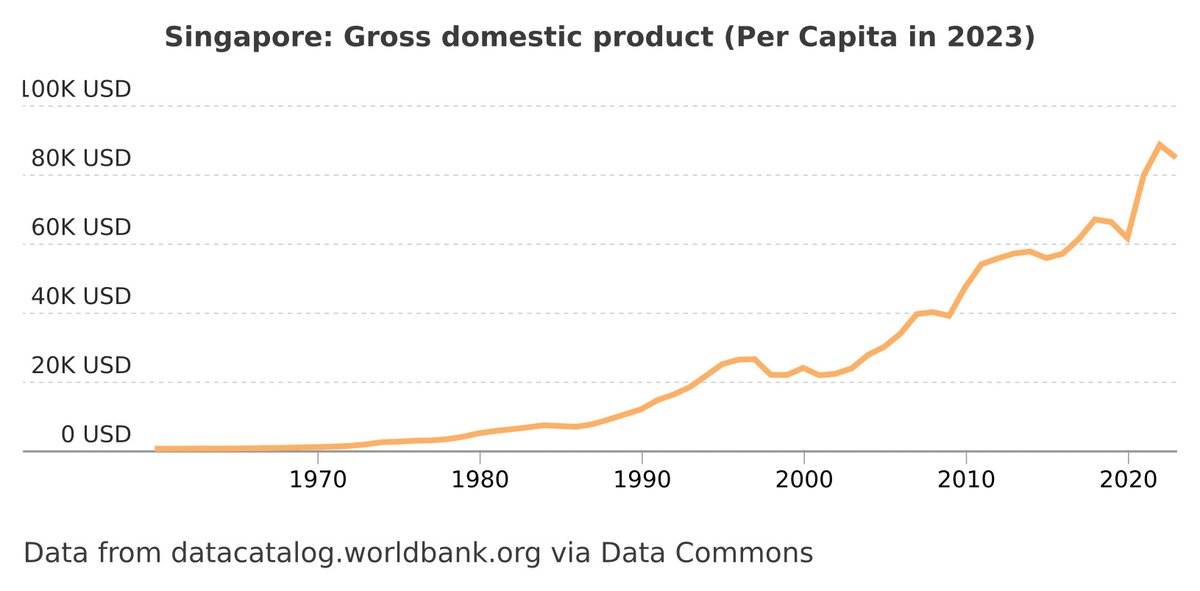

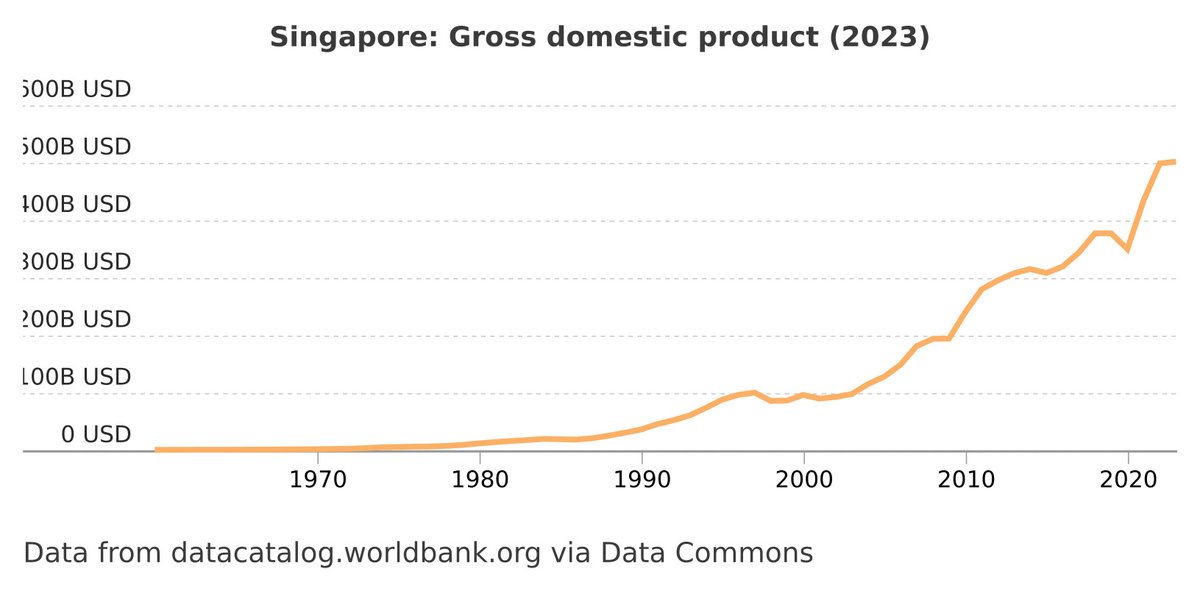

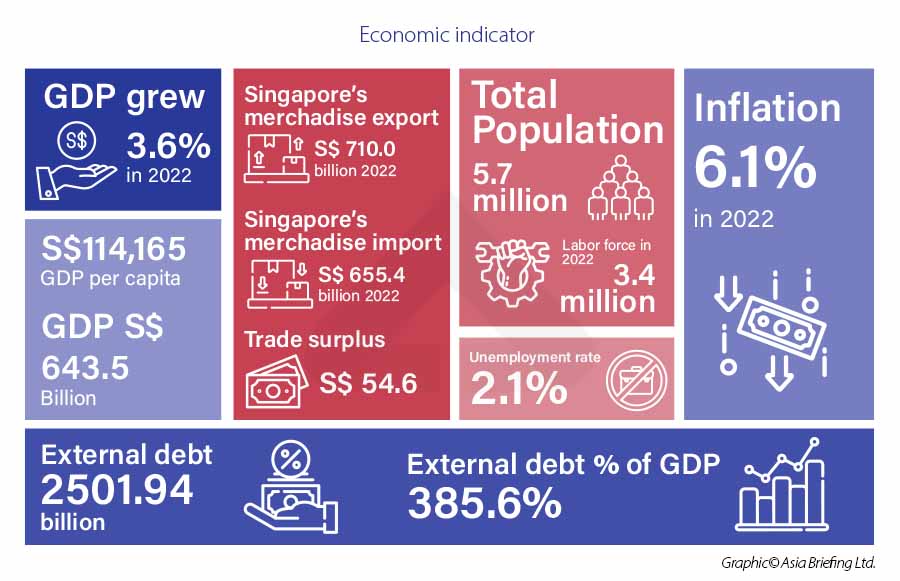

The result? • GDP per capita grew from $500 in 1965 to almost $85,000 today. • Singapore ranks among the richest nations in the world. • It’s now a major tech & finance hub.

Companies & billionaires flock to Singapore for its: • Low taxes and political stability • Business-friendly environment and top-tier financial regulations Even crypto firms like Binance & Ethereum set up shop there.

From a tiny island with zero resources to an investment empire worth over $1T, Singapore proves one thing; Strategy > Size.

If you want to build an online business and make that first $1 in 2025 Get a copy of "The Art of Twitter" This is the EASIEST WAY to get started with WiFi Money. You're on the X app anyway - might as well use it to start a business. https://gumroad.com/a/899764435/XFFpt

Read my other thread here 👇 https://x.com/BizHustlez/status/1950961438002167832