Everyone’s talking about $NVDA hitting all-time highs… But $AMD is quietly up 20% YTD - and STILL hasn’t even broken its previous peak. That won’t last long. Because Lisa Su just made the boldest AI play of the year. Here’s why $AMD could explode next - and catch Wall Street sleeping again: 👇🧵

1/ Everyone’s lost in $NVDA mania… $AMD is already up ~20% - and IT HASN’T EVEN HIT all-time highs yet. Now, post-Advancing AI, the breakout setup is more compelling than ever.

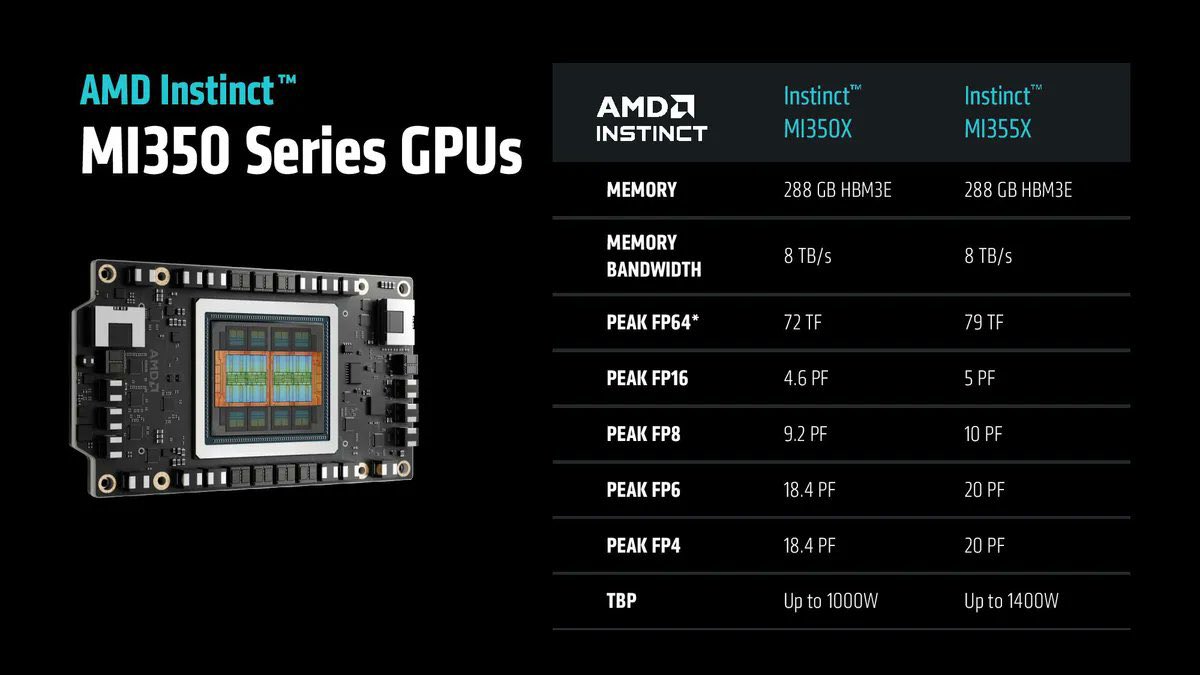

2/ This month AMD launched the Instinct MI350 Series - their “most advanced AI platform ever,” Boasting up to a 4× generational leap in compute for training & inference.

Content Warning: Adult Content

Click to Show

AD Required

3/ Specs to drool over: - 288 GB HBM - Single-GPU support for 20 B-parameter models - Claims of double FP throughput vs rivals - 1.6× more memory per card.

4/ Ecosystem proof: Partners like Meta, Oracle, Dell, HPE, Cisco, Asus lined up MI350‑based systems hitting market by Q3 2025. Enterprise adoption accelerating fast.

5/ Lisa Su says we’ve hit an inflection point in AI inference - and that inference alone will drive the datacenter AI accelerator market to a jaw-dropping $500B by 2028.

Content Warning: Adult Content

Click to Show

AD Required

6/ AI agents = compute explosion: Su noted agentic AI means “billions of new virtual users,” requiring massive CPU+GPU synergy in open ecosystems AMD sits at the heart of that pivot.

Content Warning: Adult Content

Click to Show

AD Required

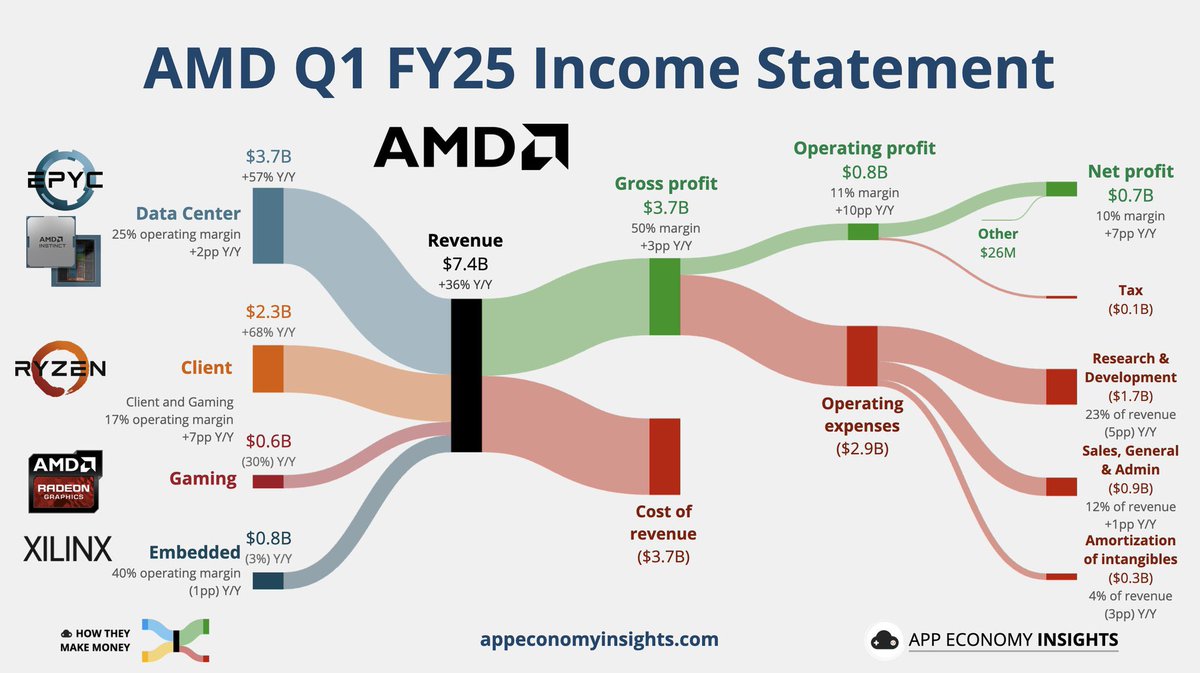

7/ Backed by rock-solid Q1: - Revenue $7.44 B (+36% YoY) - Data center up 57% - EPS +55%. Guidance raised to ~$7.4 B for Q2 despite ~$700 M headwind from export controls.

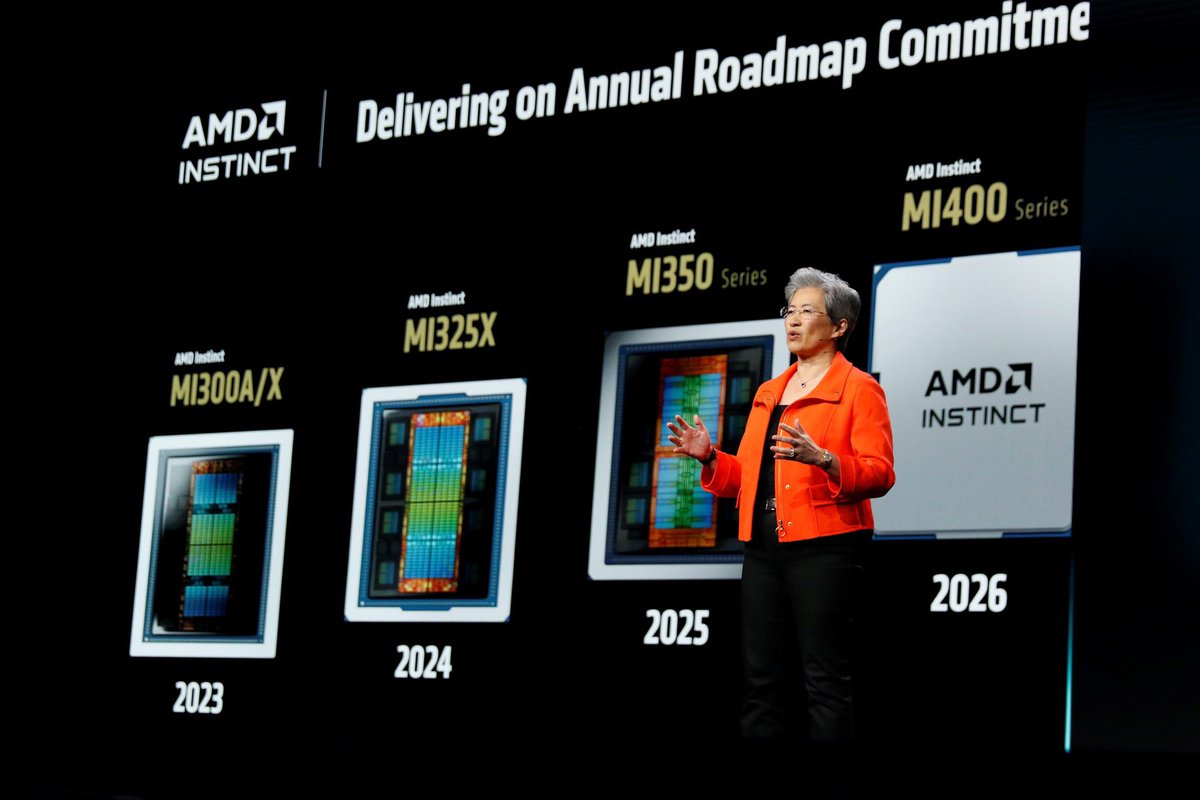

8/ MI300 family has already generated over $5 B in revenue since launch. MI350 is primed to carry that tail into 2026 with MI400 on the roadmap.

9/ Analysts are waking up: - Cantor sees $4.11 EPS next year - Melius bumped to $175 - Rosenblatt targeting $200. All pointing to mid‑teens to double from here by year‑end.

10/ Summary: AMD is now firing on all cylinders. - Game-changing product - Open strategy - Enterprise traction - Strong fabric in Q1+ - IPO-like growth structure, but in an established $200 B chip leader. Next stop: All‑time high → $250 → $300?

12,000+ smart investors already get our top undervalued stock picks - before the crowd. Why wait? Get this week’s picks now, free: https://www.dividendtalks.com/subscribe