In the 90s, Donald Trump was on the brink with $990 MILLION of debt.

The New York Post called him "UH-OWE!" and banks seized his yachts, towers, and helicopters...

But what he did next rewrote the wealth playbook forever.

Every entrepreneur should understand this...🧵

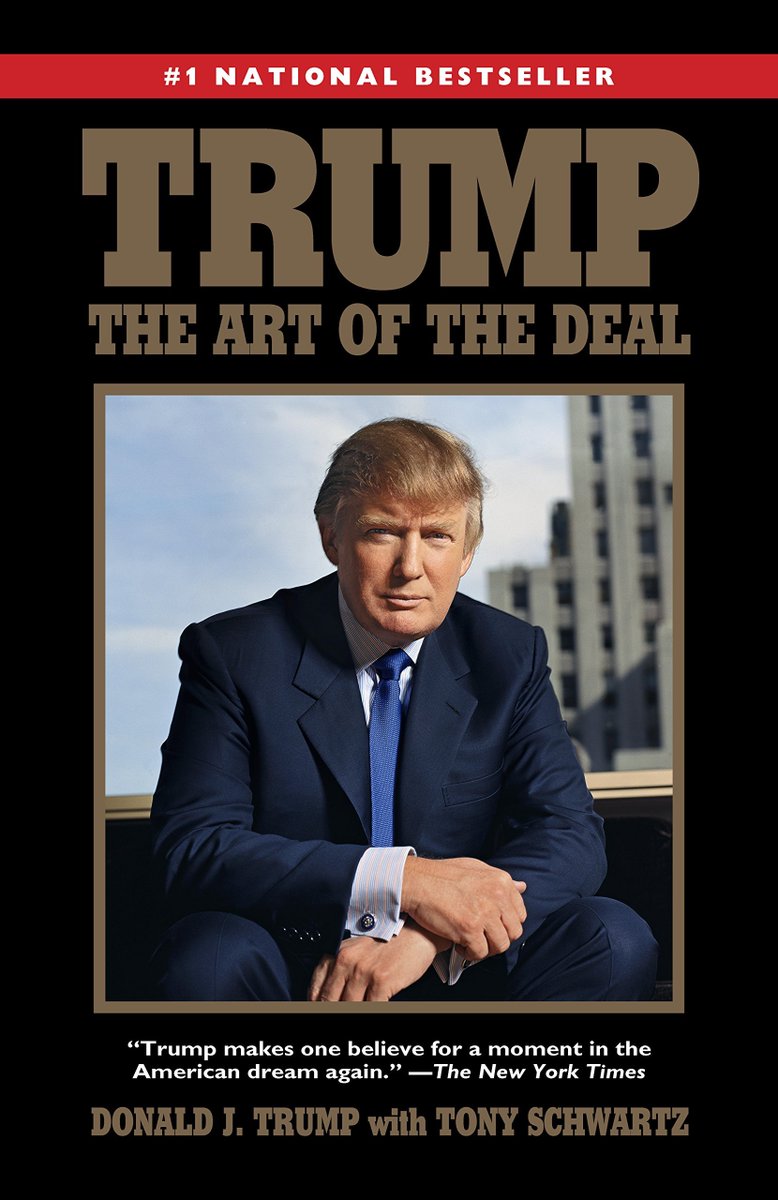

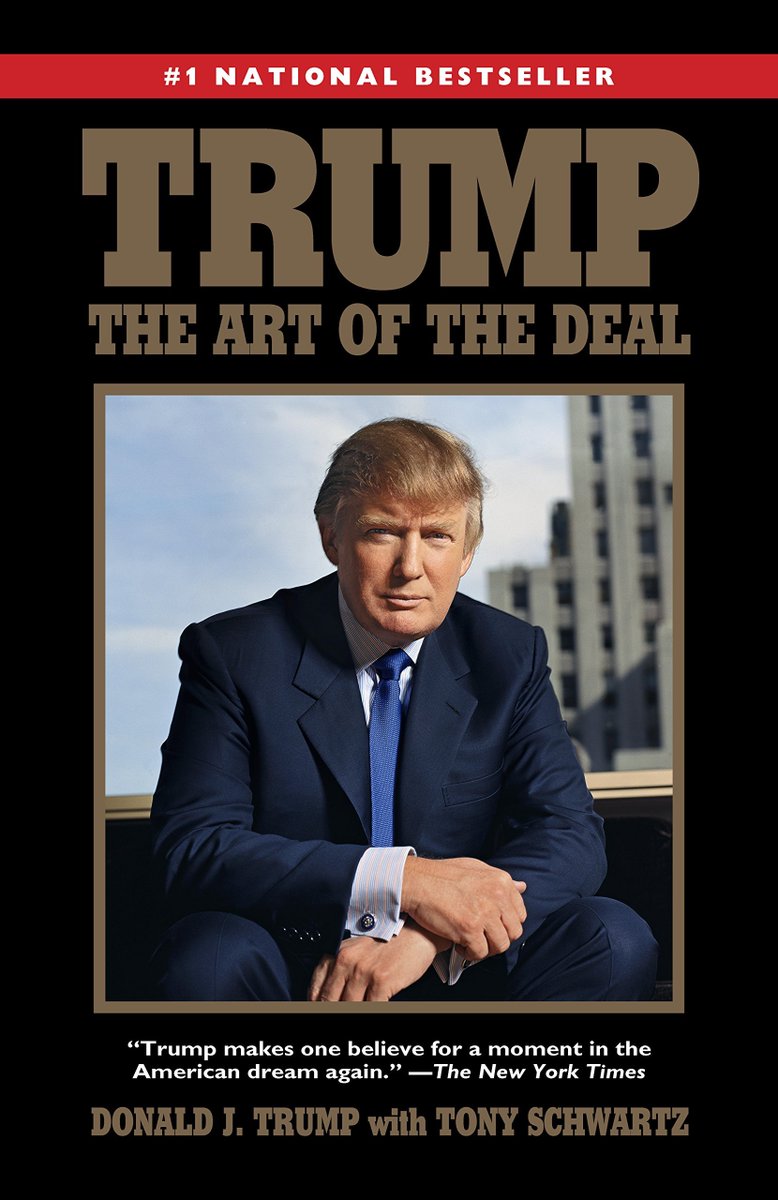

October 1987: Trump seemed untouchable.

"The Art of the Deal" hit #1 on bestseller lists.

Forbes valued him at $1.7 billion.

Fortune called him a business genius.

But behind the glamour, a disaster was brewing...

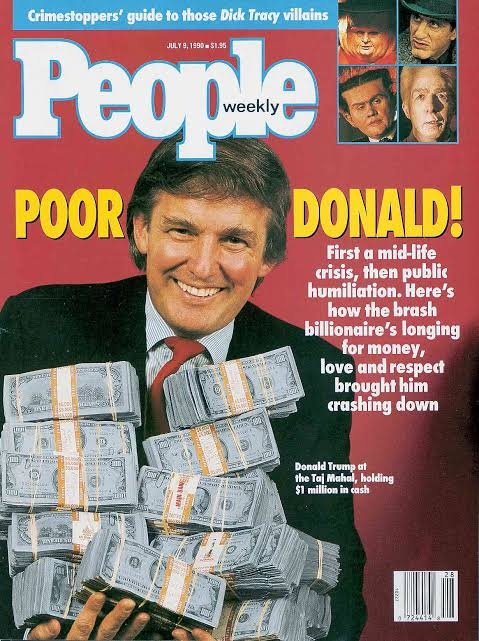

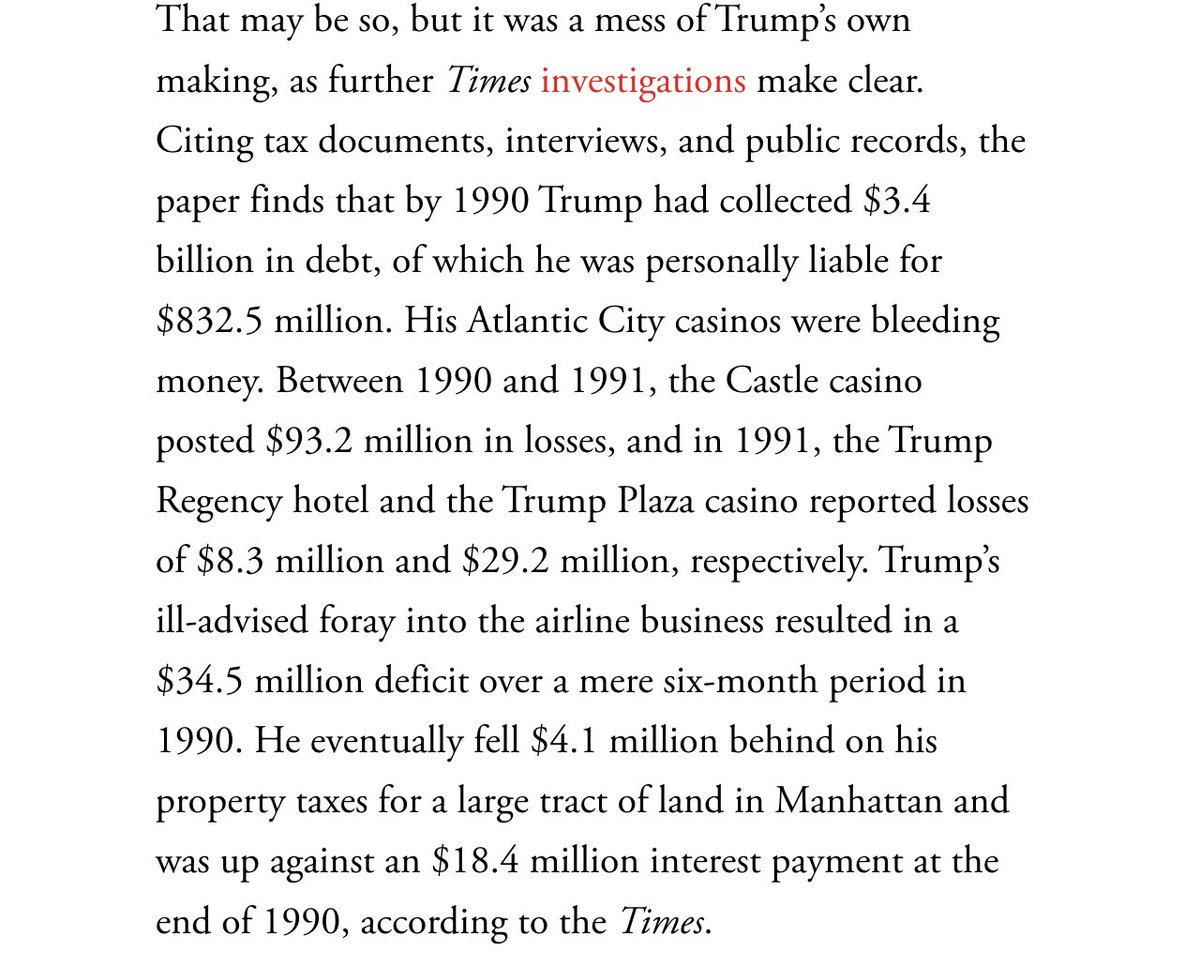

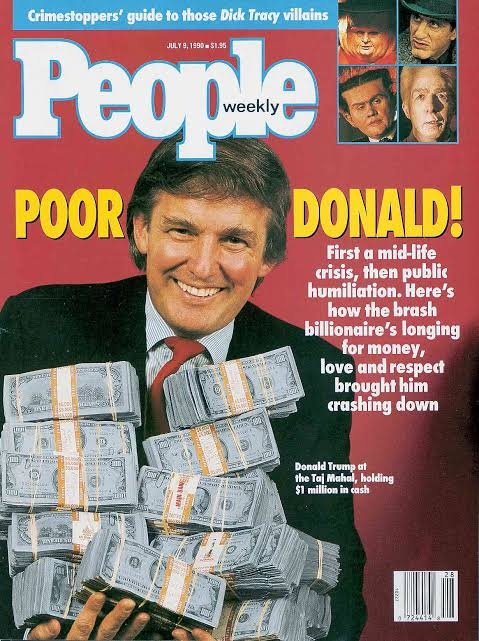

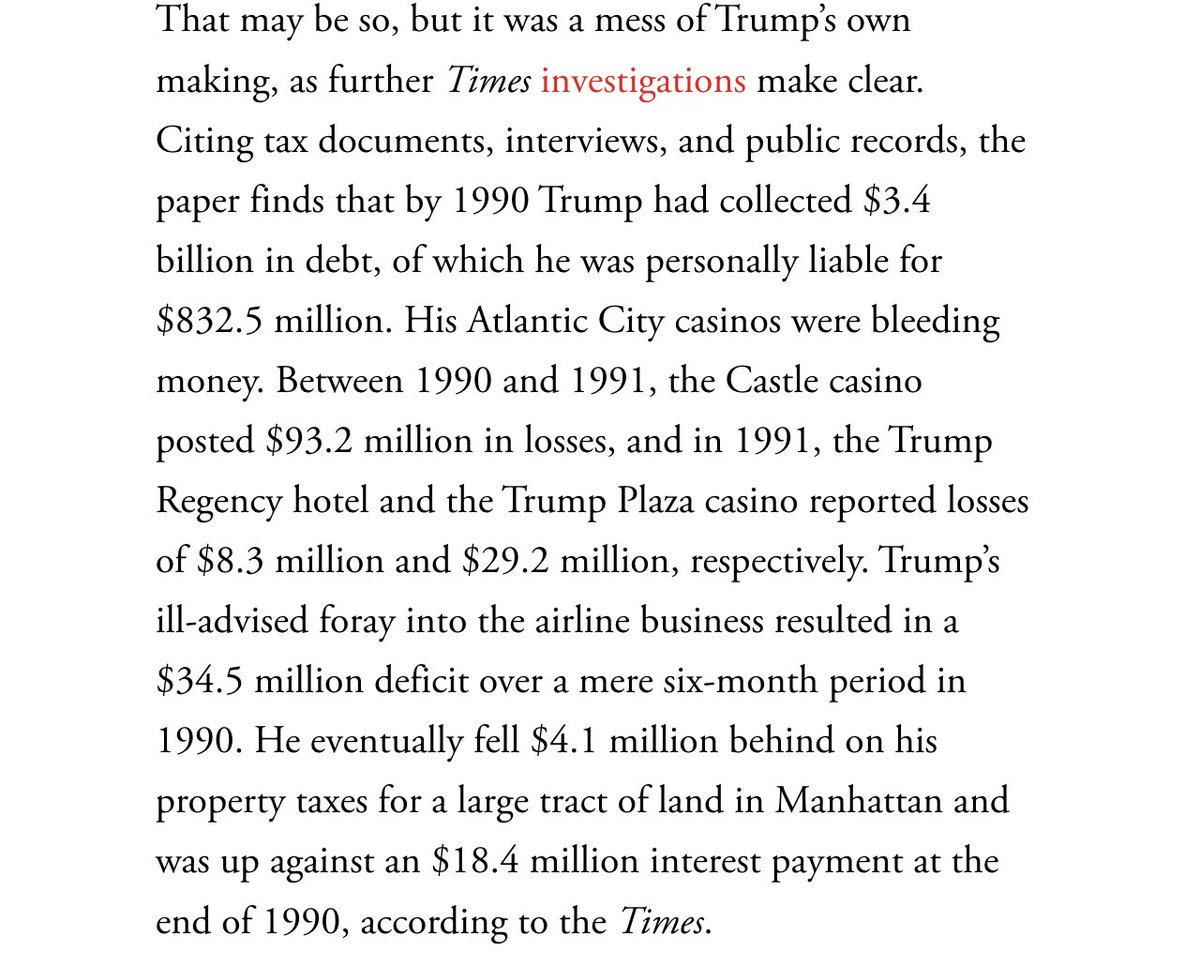

1990: The recession hit like a sledgehammer.

Newsweek described Trump as "tarnished by marital scandal, mired in debt and negotiating with banks."

His debt? A staggering $3.2 BILLION.

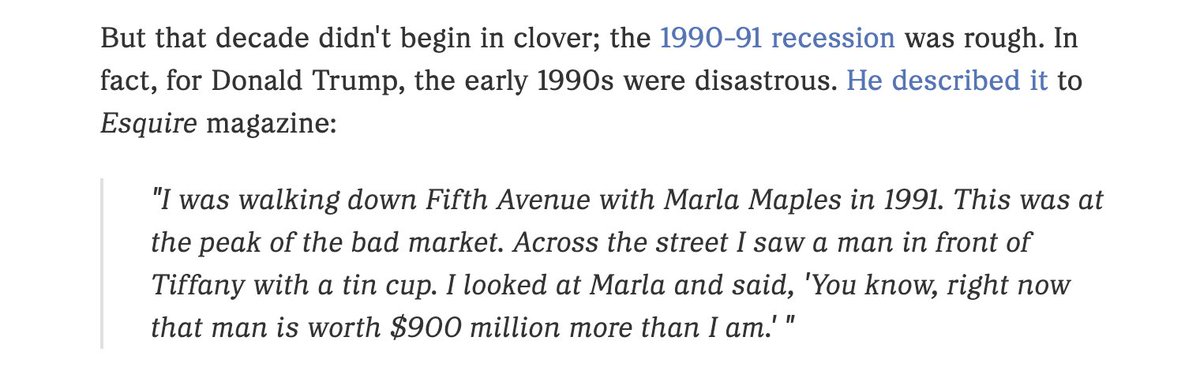

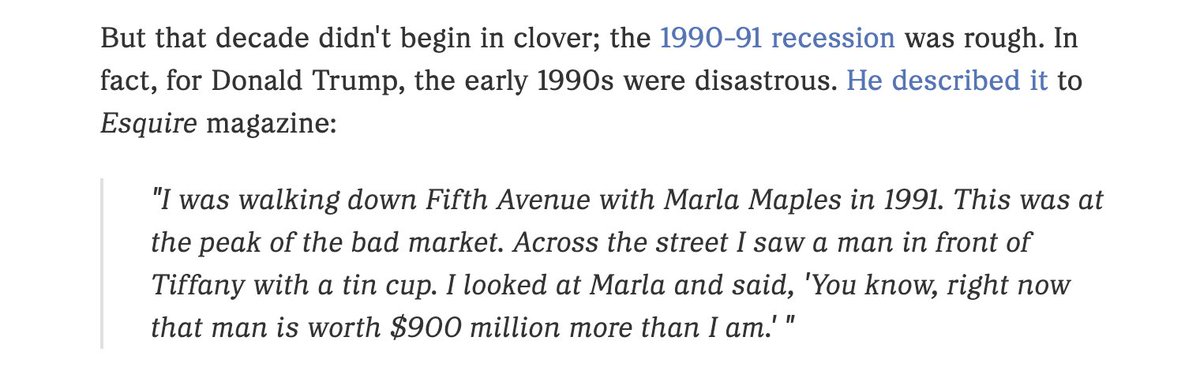

By 1991, it got so bad Trump told this story to Esquire...

The IRS numbers tell the real story:

From 1985 to 1994, Trump lost more money than any other American taxpayer.

$1.17 BILLION in losses over 10 years.

His core businesses never made a profit. Not once.

Here's how the empire collapsed...

Trump's disaster started in the go-go '80s:

• Borrowed millions to enter Atlantic City gambling

• Took over the half-finished Taj Mahal Casino in 1988

• Bought Trump Shuttle airline

• Acquired hotels, properties, yachts

When recession hit in 1990? Total catastrophe.

The bankruptcies came like dominoes:

1991: Taj Mahal filed for bankruptcy

1992: Trump Castle filed

1992: Trump Plaza filed

His airline? Never turned a profit.

"By spring 1990 I was deeply in the red; my empire was hemorrhaging value," he later admitted.

The Vanity Fair reported:

The banks didn't just call the loans.

They took control of his life.

They appointed a "financial monitor" to watch every dollar.

The great dealmaker was put on a $450,000 monthly allowance.

Wall Street wrote his obituary...

The seizures were brutal:

• His 282-foot yacht "Trump Princess"

• Personal helicopter

• Trump Shuttle airline

• Stakes in department stores

Everyone thought Trump was finished. But 1995 became his turning point...

Trump's escape wasn't about luck or connections—it was a masterclass in turning disaster into opportunity.

He discovered three strategies that no bankrupt businessman had ever combined before, and they changed everything about how we think about failure and comeback.

Here's what he did...

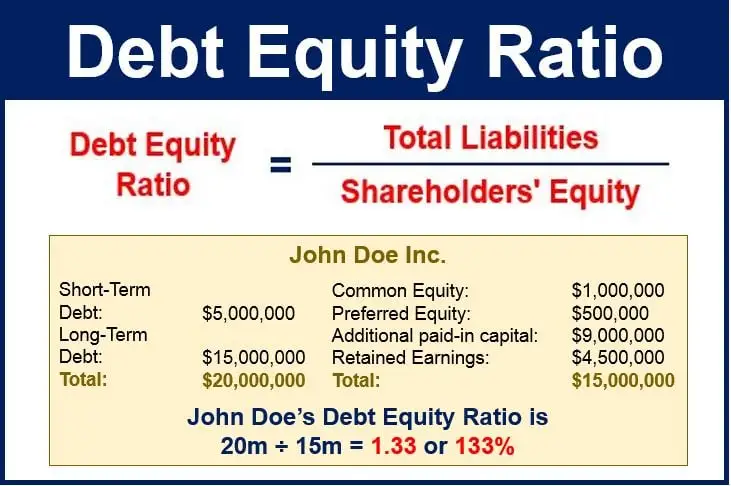

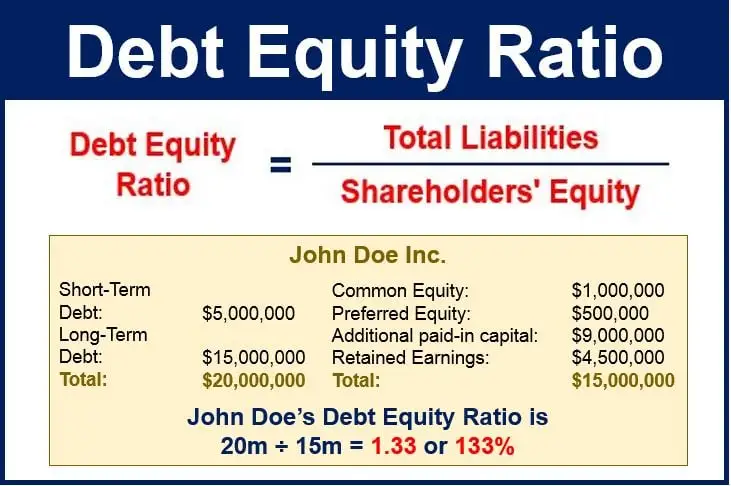

1/ Equity-for-Debt swap

Instead of scrambling for cash he didn't have, he offered banks something more valuable: ownership stakes in his properties.

At Trump Plaza Hotel, bondholders accepted 49% equity to forgive $550 million in debt.

The genius was in the details—by giving banks equity, he transformed them from adversaries into partners.

Now they needed him to succeed as badly as he did, because empty Trump properties without the Trump name were worthless.

But his second move was even more brilliant...

2/ While banks took ownership of his buildings, Trump negotiated to keep operational control.

He convinced them that Trump properties needed Trump himself to maintain value, so he continued managing the assets while collecting fees—with zero downside risk if they failed.

In a nutshell: He lost ownership but kept getting paid to run the properties.

The banks realized they'd bought expensive real estate that only worked with his name attached, so they had no choice but to keep him involved.

Then came his 3rd and most innovative strategy...

3/ Mastering publicity

While technically bankrupt, Trump turned his personal publicity into a new currency.

He appeared at casino openings, hotel launches, and business events—not as an owner, but as "Donald Trump, the brand."

Each appearance commanded fees, and controversy only made him more valuable.

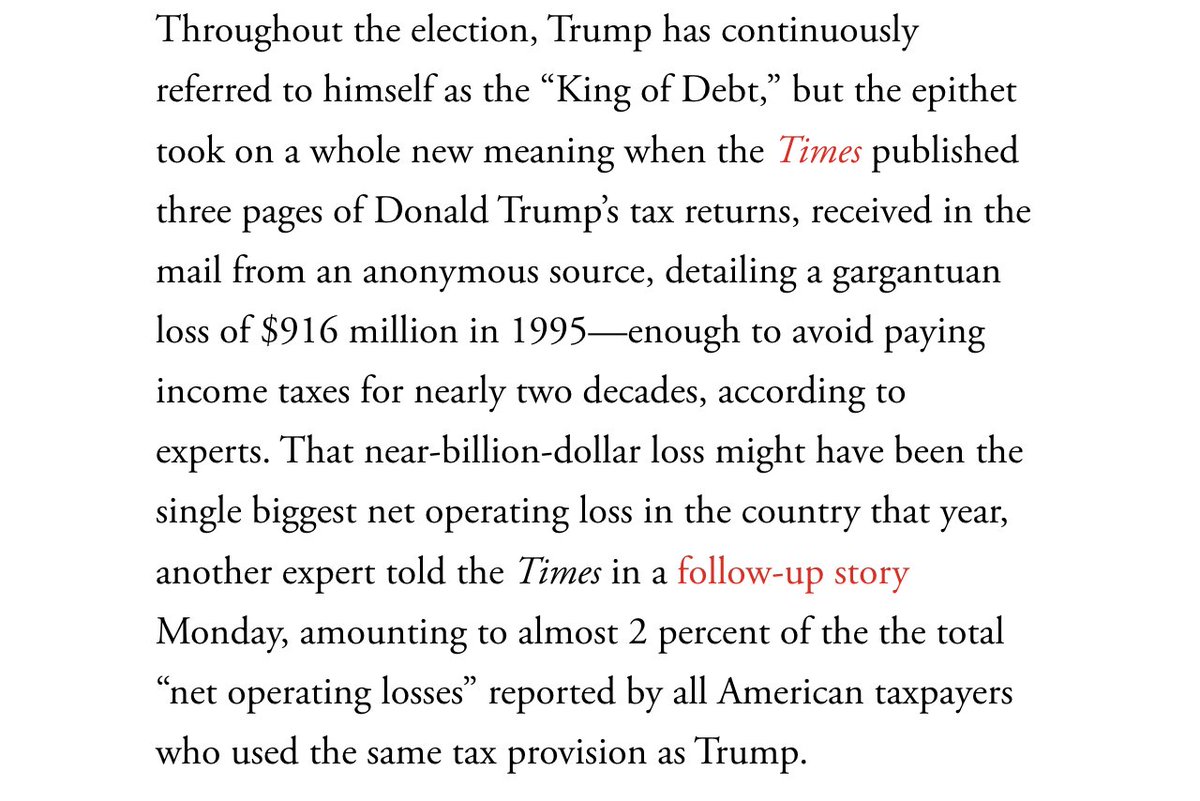

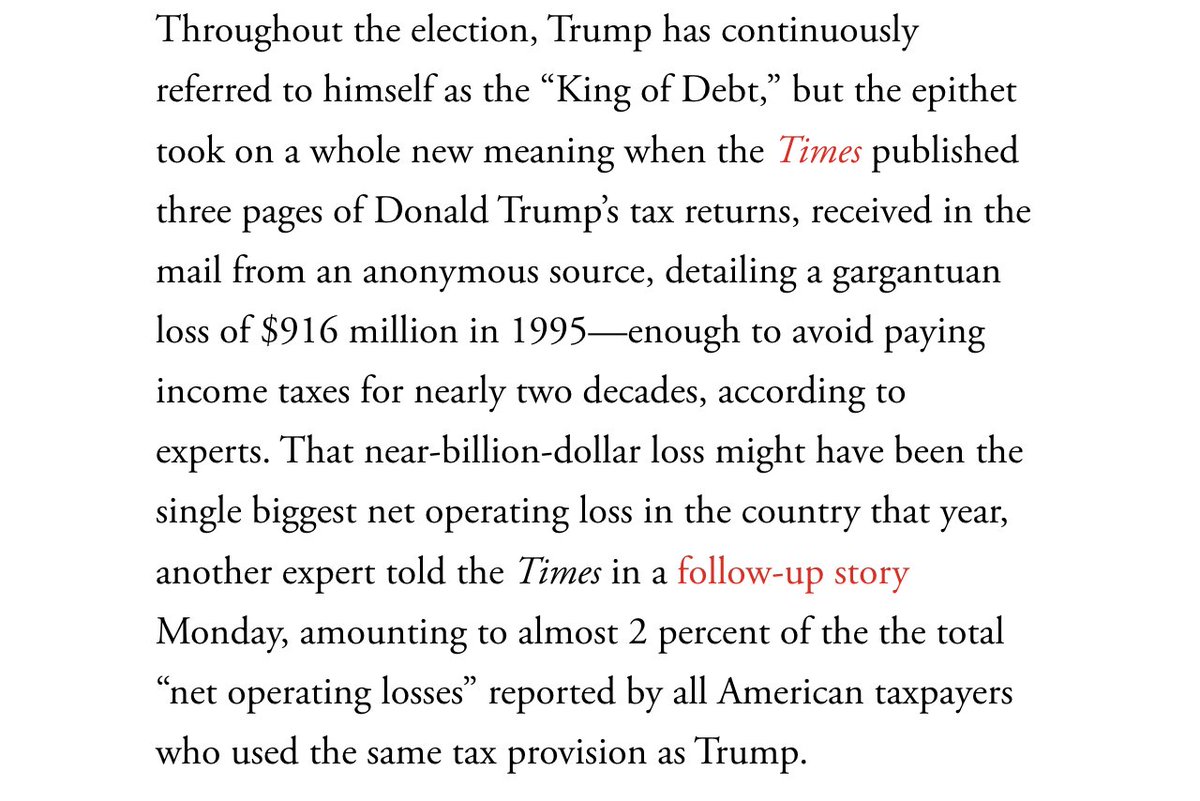

The tax implications were wild:

That $916 million loss in 1995 created a shield against $50 million in annual income.

For over 18 years, he could rebuild his empire while legally avoiding federal income taxes on massive earnings.

But what he did next changed business forever...

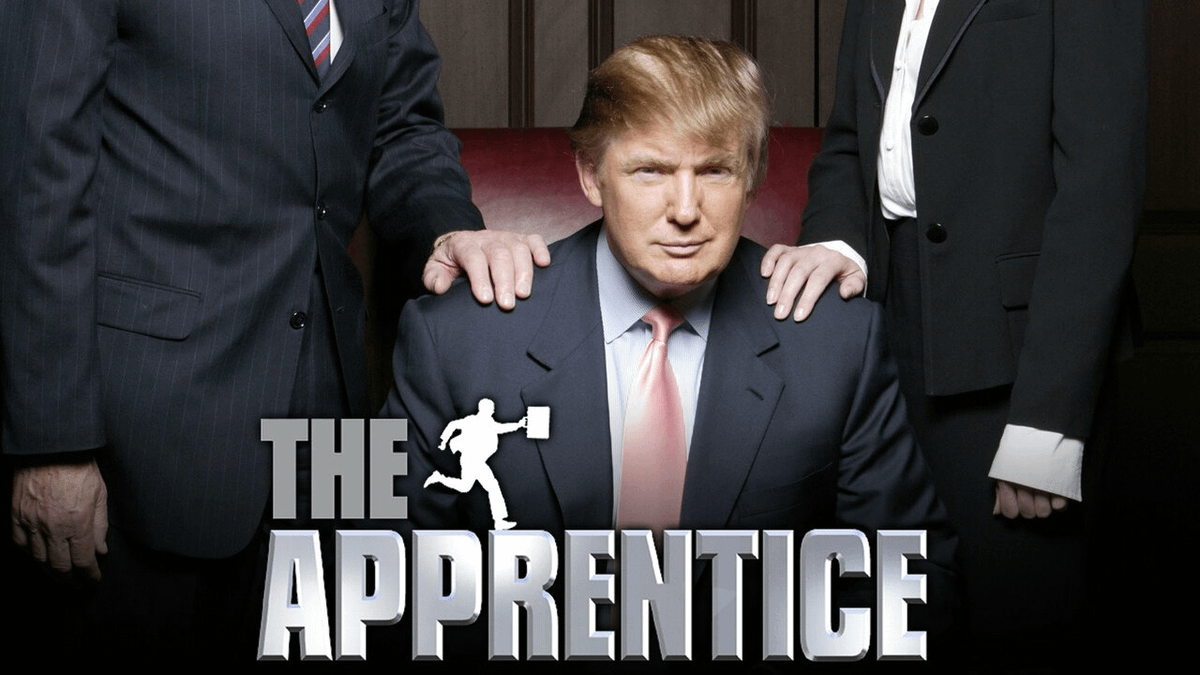

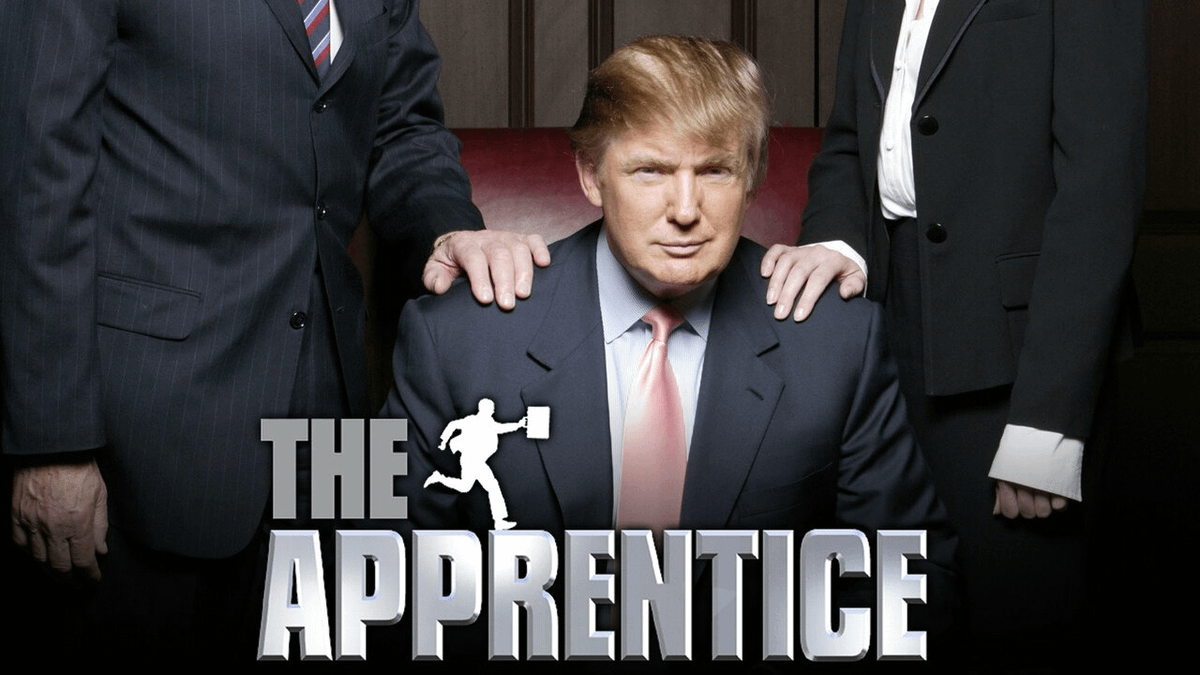

From 1996 forward, Trump essentially created the first "human IPO."

Instead of selling shares in companies, he sold shares in his personal brand.

He licensed his name for $1.5 million per building, collecting royalties without risking a penny of capital.

No bankruptcy court could seize a name, no creditor could foreclose on a reputation.

By 2004, "The Apprentice" proved his theory correct.

14 seasons and $427 million in revenue, all from monetizing his personal brand rather than physical assets.

Here's what Trump understood that others didn't:

Stop owning. Start licensing.

Buying buildings → licensing his name

Funding projects → collecting royalties

Risking capital → monetizing reputation

The brand survived when the buildings didn't.

Hi, I'm Ken Berenger.

I've spent 35 years as an entrepreneur, elite sales trainer, and risk-taker who's had to rebuild from nothing—twice.

My mission on X is to share the formula for asymmetric wealth that cost me years, so you can get there faster.

Follow me @KenBerenger

Fellow investors: We're pioneering water infrastructure as a pure capital play.

We are converting $1T in stalled projects into 20-year recurring revenue streams at 20.3% projected returns.

Where others see municipal bonds, we see a new asset class...

https://www.manhattanstreetcapital.com/waterondemand

My mission is to share wisdom from the greatest wealth builders and spotlight once-in-a-lifetime opportunities that everyday people can access.

Follow me @kenberenger and let's debunk the secrets of wealth.

RT the tweet below to spread the word: